The United States has strongly supported the establishment of more chip factories in the U.S. despite warnings by the retired chief executive of Taiwanese chip giant TSMC that efforts to revive U.S. chip manufacturing are "futile."

Intel partners are cheering the chip giant's move to build more foundries in the U.S., even though a former Taiwanese semiconductor chief has described it as a futile effort.

"It's exciting to see all the investments Intel is making, especially in the U.S.," said Kent Tibbils, vice president of marketing at Fremont, Calif.-based ASI Corp., a longtime distributor of Intel chips. "They're a semiconductor company, they know how to do state-of-the-art manufacturing, state-of-the-art packaging, advanced engineering, and they know how to do it all at scale. They bring a lot of resources, skills and history with them." Tibbils believes that more U.S. chipmakers, whether Intel or foreign manufacturers such as TSMC or Samsung, would be "significant" in improving the supply chain crisis plaguing the industry.

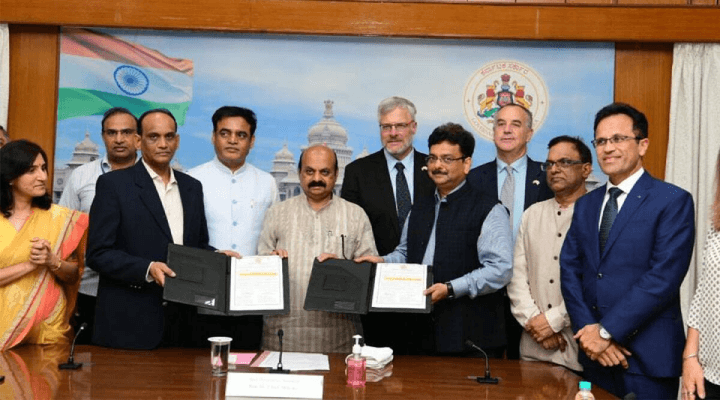

Compugen President Harry Zarek, an Ontario-based No. 53 on the CRN SP500, said that as China's new Covid restrictions further impact the tech industry's supply chain, it's time to start manufacturing to bring you closer to home. "If you can't get a product to market, producing at the lowest cost is a flawed strategy," he said. "It's time to look beyond conventional thinking in the tech ecosystem." The strong support for more U.S. chip fabs remains despite a warning by Zhang Zhongmou, the retired chief executive of Taiwanese chip giant TSMC, that efforts to revive U.S. chip manufacturing may be "futile."

Compugen President Harry Zarek, an Ontario-based No. 53 on the CRN SP500, said that as China's new Covid restrictions further impact the tech industry's supply chain, it's time to start manufacturing to bring you closer to home. "If you can't get a product to market, producing at the lowest cost is a flawed strategy," he said. "It's time to look beyond conventional thinking in the tech ecosystem." The strong support for more U.S. chip fabs remains despite a warning by Zhang Zhongmou, the retired chief executive of Taiwanese chip giant TSMC, that efforts to revive U.S. chip manufacturing may be "futile."

"Right now, you're just talking about subsidies that cost tens of billions of dollars," Chang said on a Brookings Institution podcast. "Well, that's not enough. I think it's going to be a very expensive exercise in vain." Chang noted that TSMC's U.S. chip business in Oregon is 50 percent more expensive than its Taiwan business. "It's just a bunch of nasty surprises," he said of TSMC's U.S. factory. "When we first started, we really wanted the cost to be comparable to Taiwan. That was naive."

Taipei-based global chip research firm TrendForce believes Taiwan's chip dominance continues despite U.S. investment in chip manufacturing facilities. According to TrendForce, Taiwan's 26% semiconductor sales market share and 47% global foundry capacity cement the country's dominance in the chip market in the coming years. According to TrendForce, Taiwan has 24 "fabs," or chip manufacturing bases, followed by China, South Korea and the United States.

The global Covid-19 pandemic has caused a surge in chip demand and sales over the past two years, despite hampering global supply chains. Countries around the world saw the disruption in supply chains as a wake-up call and began a long process of localizing chip manufacturing, with China, the United States and Europe all announcing the construction of new factories.

But TrendForce said Taiwan's lead in the semiconductor race may be too large to be overcome with several new fabs. According to TrendForce, six new fabs are under construction in the country.

According to Gartner, a research firm based in Stamford, Connecticut.

Taiwanese foundries operated by TSMC, UMC (UMC), Powerchip Semiconductor (PSMC), and Pioneer International Semiconductor Corporation (VIS) will account for 64% of the foundry revenue market share in 2021, and TrendForce says these companies will increase 2% of that in 2022 The foundry market will be worth $128.7 million in 2019.

TrendForce said Intel's planned wafer foundries in the U.S. and Europe, as well as other factories planned by Chinese, Singaporean and Japanese companies, have done little to damage Taiwan's chip base. "Judging from the existing expansion plans, by 2025, Taiwan will still control 44 (%) of the global foundry capacity and up to 58 (%) of the global advanced process capacity, thus continuing to dominate the global semiconductor industry", TrendForce said in a blog post.